On 23 March 2022, Ms Suzana Che Saruji, a chartered accountant and tax practitioner who is also a member of the Industry Advisory Board 2021/2022 of SEGi College Penang, gave a free webinar about the Malaysia Personal Income Tax filing (BE Form). Because we all have a responsibility to pay our fair share of taxes within the country, this webinar will assist parents, alumni, students, and employees of SEGi College in doing so.

Participants will be exposed to essential information from the most recent budget for the year 2021, as well as how we might reduce the tax burden. It began with a welcome greeting by the host, Ms Khairun Syafiza Khairuddin, a lecturer/programme leader in the School of Business and Accounting, and continued with the opening speech by the Head of School, Dr Vivien Ting.

“It is our responsibility to file the tax return within a stipulated time, more so, submit a complete and correct tax return is crucial,” said Dr Ting.

Miss Suzana, a partner of SA Accountants Ltd, was invited to speak about her experience with the BE form. She has a diverse background in accounting and has been in business for over sixteen years, holding many professional licenses and memberships. She is also engaged in sharing her knowledge and skills with non-profit organizations and corporations, in addition to higher educational institutions.

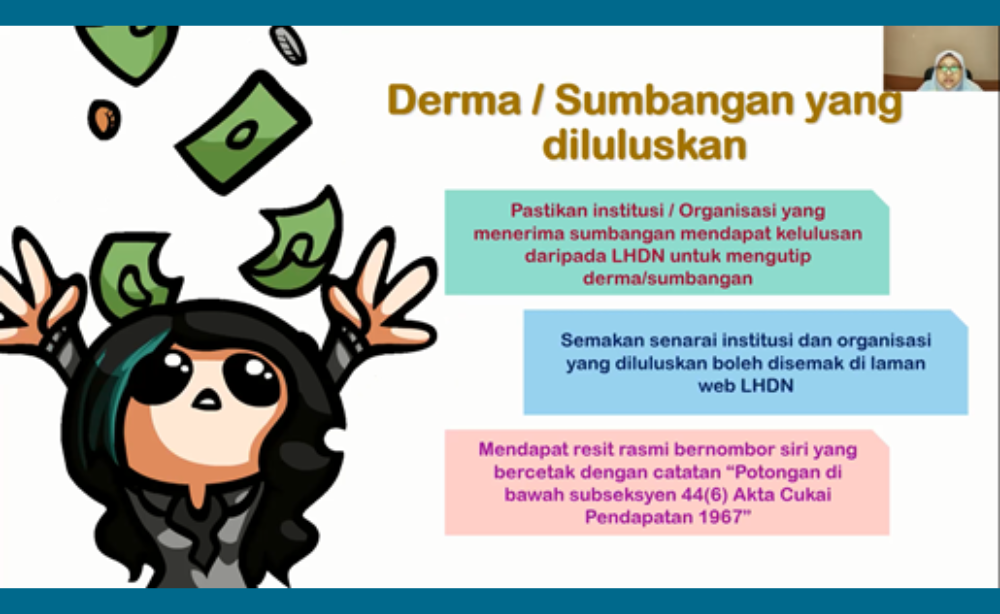

As Malaysian resident individuals, taxpayers must file their BE form no later than 30 April each year, and those who operate a business must file their B form no later than 30 June each year. This session sought to go through in-depth the reliefs that have been announced for the fiscal year 2021. The discussion covered income tax, the self-assessment system, taxable income under Section 4 of the Income Tax Act 1967, allowed donations under Section 44 of the Income Tax Act 1967, reliefs and rebates, as well as the taxpayer’s responsibilities. Ms Suzana also shared her personal experiences with the participants about cases that had been submitted in the past.

In addition, she highlighted three important tips to remember before filing the tax returns as follows:

- Take note of the e-filling 2021 deadline

If you’re a very busy person, or if this is your first time doing this, you might just forget to fill up the BE form on time. But it is crucial to follow the rules and regulations when it comes to filing a tax form.

2. Keep all your receipts

When claiming exclusions and reliefs, make sure you have all of the necessary paperwork. For example, if you spent RM2,000 on a new laptop and want to claim it, save the receipt as proof of purchase. You must preserve such proof/documents for up to 7 years from the end of the assessment year under Section 82A of the Income Tax Act 1987.

- Be honest and accurate when filling up the form

And while we’re on the subject of proof and paperwork, it is crucial to provide the exact amount of income and exemptions. Anyone who falsifies an entry on a tax form is subject to “a fine of not less than one thousand ringgit and not more than twenty thousand ringgit, or to imprisonment for a term not exceeding three years, or to both,” according to Section 114 of the aforementioned Act. As a penalty, they will have to pay three times the tax amount that was undercharged. Of course, taxpayers will only be fined under this Section if they are knowingly declaring an incorrect amount. However, the taxpayer can alter the tax form only if a real mistake has been made.